2021 Available Tax Incentives for Energy Efficiency Improvements

What is the 45L Tax Credit?

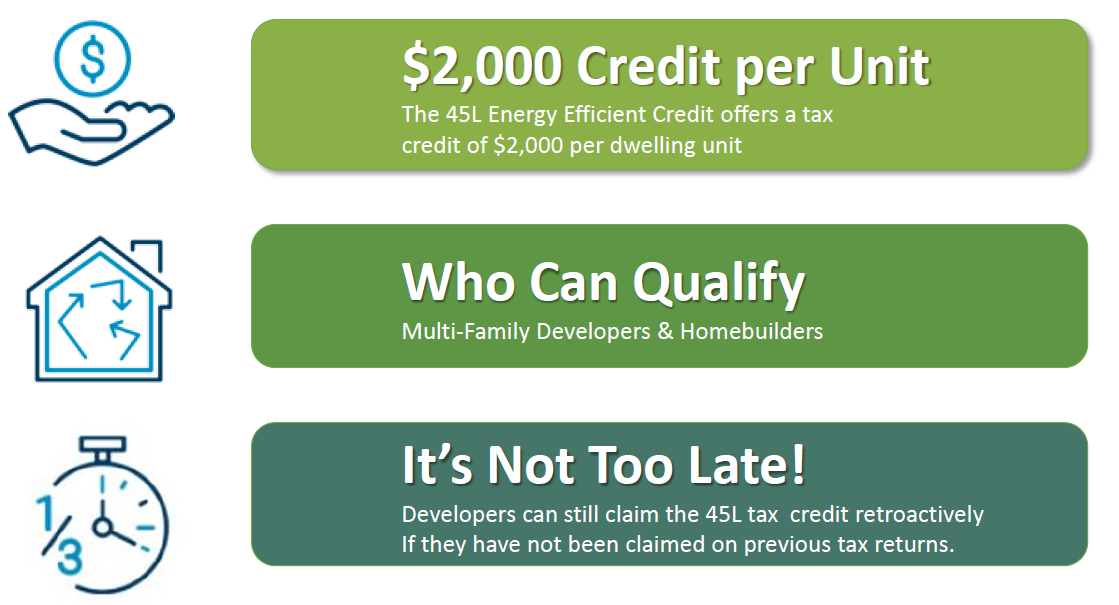

The 45L Tax Credit is equal to $2,000 per unit for qualified owner-occupied or rental dwelling units that meet certain energy-savings standards. Construction or rehabilitation of a unit must be substantially completed after August 8, 2015 and the unit sold or leased before the end of 2021. The tax credit is claimed by the developer (known as Eligible Contractor) in the year which the unit is occupied.

Who is the Eligible Contractor?

The 45L credit is available to an eligible contractor in the year the certified dwelling units are leased or sold. For the purposes of 45L, a person or company must own and have basis in the qualified energy efficient home during the construction to qualify as the eligible contractor with respect to the home. For example, if a person hires a third-party contractor to construct the home, and has basis in the home during its construction, the person that hires the third-party contractor is the eligible contractor and the third-party contractor is not the eligible contractor.

Eligible Properties

The $2,000 tax credit is achieved for “each” dwelling unit within the building(s). Qualifying properties are comprised of a dwelling unit, or units. A dwelling unit is defined as one or more rooms including a kitchen and designed as a unit for occupancy by one family for the purpose of cooking, living and sleeping. In order to meet the requirements of Sec?on 45L, it must also be 3 stories or less above grade and may include apartments, condominiums, assisted living facilities, student housing dwelling units, townhouses, and single-family homes.

Each unit must meet a level of energy efficiency that is higher than 2006 IECC standards. Many newer or rehabbed developments already exceed these standards based on recent energy standards and building codes. We recommend that any apartment or condominium project developed (new construction or rehabilitation) within the past four years to be evaluated for the 45L Tax Credit.

Section 179D Tax Deduction

As part of the Consolidated Appropriations Acts, 2021 signed into law on December 27, 2020, the energy efficient commercial buildings deduction (IRC Sec. 179D) is now made permanent.

What Is IRC Sec. 179D?

IRC Sec. 179D is a popular tax incentive that provides building owners and eligible designers/builders the opportunity to claim a tax deduction of up to $1.80 per square foot for installing qualifying energy efficient systems and buildings. Tenants may be eligible if they make the construction expenditures. The tax deduction applies to both new construction and retrofits. Qualified buildings include:

- Commercial buildings, including warehouses and parking garages;

- Multifamily properties with four stories or more; and

- Government-owned buildings, such as public universities, libraries, etc.

To qualify, the energy efficient property must reduce the energy and power costs of a building located in the United States by 50% or more in comparison to the minimum requirements of ASHRAE Standard 90.1. If the 50% target saving is not met, the provision allows partial deduction of $0.60 per square foot for each of the following components:

- Interior lighting systems meeting a 25% saving;

- Heating, cooling, ventilation, and hot water systems meeting a 15% saving; and

- Building envelope meeting a 10% saving.

The deduction cannot exceed the cost of qualifying property. There are also alternative guidance for partially qualifying property of lighting systems known as “Permanent Rule” and “Interim Rule.” If a deduction is allowed under IRC Sec. 179D with respect to the energy efficient property, the basis of such property will be reduced by the amount of allowed deductions.

Potential Tax Saving from IRC Sec. 179D

An energy project costing $19,500,000 is completed for a commercial building with 600,000 square feet. Typically, the improvement is depreciated over 39 years and provides annual depreciation of $50,000. With the qualified IRC Sec. 179D deduction, additional depreciation can be taken in the year that the energy efficient property is placed in service, resulting in significant benefit to the taxpayers:

- 600,000 sq ft x $1.80 benefit rate = $1,080,000

- The basis of the energy efficient property will reduce by $1,080,000, and the remaining basis of $18,420,000 will be depreciated over 39 years.

Certification Requirements

In order to qualify for the deduction, the energy efficient property must receive proper certification by licensed engineers or contractors as meeting various energy efficiency standards. The qualified individuals will perform field inspections in accordance with guidelines from the National Renewable Energy Laboratory (“NREL”) and calculate the energy and power cost savings with software approved by the Department of Energy.

Government-Owned Buildings and Eligible Person

For energy efficient property installed on or in buildings owned by a federal, state, or local government, the deduction can be allocated to the person primarily responsible for the property’s design. Eligible persons include designers, architects, engineers, contractors, or energy consultants. The person needs to secure an allocation letter that allows the government entity to transfer the benefit.

How To Claim IRC Sec. 179D

Taxpayers can take the IRC Sec. Sec 179D deduction in the current tax year if they receive the proper certification and/or allocation letter at the time of tax filing.

There are different filing requirements to take the deduction for the energy efficient property placed in service in prior years.

Building owners may use Form 3115, Change in Accounting Method, to retroactively take the deduction in a current year tax filing.

On the other hand, eligible designers or builders of government-owned buildings have to amend their tax returns in order to take the deduction. Hence, they can only file for open tax years, generally three years from the date of filing.

A special tax rate is available to qualified residential and commercial energy-efficient buildings, not including the land on which they are located. Qualified buildings must be determined to be an energy-efficient building by a qualified licensed engineer or contractor who is not related to the applicant, as required by Section 58.1-3221.2 of the Code of Virginia.

- Applications are available on-line, at the Real Estate Assessor’s Office, and at the Planning Department’s Office of Permits and Inspections located at 2875 Sabre Street, Suite 500, Virginia Beach, VA 23452. The phone number is (757) 385-4211, option 3.

- Once completed, the application is to be submitted to the Planning Department’s Office of Permits and Inspections, 2875 Sabre Street, Suite 500, Virginia Beach, VA 23452. The phone number is (757) 385-4211, option 3.

- The approved application, plus the additional required information, will be submitted to the Planning Department’s Office of Permits and Inspections for review.

- If the application is approved, the owner will then bring a copy to the Real Estate Assessor’s office for their processing. The Real Estate Assessor is located at the Municipal Complex – 2424 Courthouse Drive, Building #18, Virginia Beach, VA 23456. The phone number is (757) 385-4601.